全球付费电视行业的核心削弱趋势的真相

发表于 2018-05-03 14:34

阅读数: 14199

2017年,在14个市场中,由于有线电视收费的下调,付费电视订购数量有所下降。

伦敦(2018年5月3日)——威胁全球付费电视行业未来的核心削减趋势不仅仅局限于2017年的美国;其他13个市场的付费电视用户总数也有所下降。根据商业信息提供商IHS Markit(纳斯达克交易代码:INFO)的数据,客户取消他们的电视服务,转而支持在线服务,这是有线电视、卫星电视、IPTV和全球付费数字电视的订阅量下降的一个关键因素。

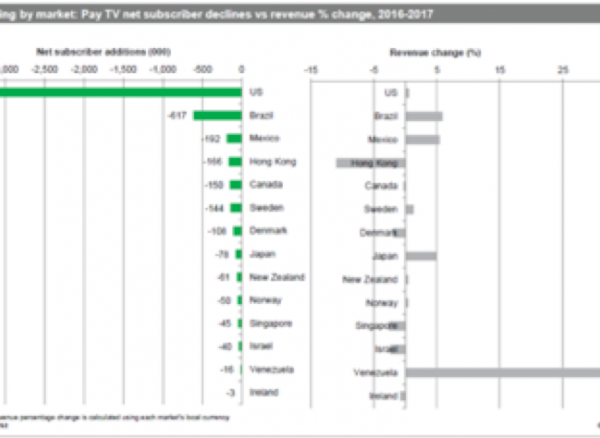

IHS Markit数据显示,除美国之外,去年全球付费电视用户总数下降的13个市场分别是巴西、墨西哥、香港、加拿大、瑞典、丹麦、日本、新西兰、挪威、新加坡、以色列、委内瑞拉和爱尔兰。

IHS Markit的电视和视频研究和分析主管泰德·霍尔(Ted Hall)表示: "美国的付费电视公司亏损已经被公开了,尽管世界其他地区普遍抵制这种趋势,但其他市场也出现了付费电视订阅亏损。”

值得注意的是,在2017年受到影响的14个市场中,仅有6个城市的付费电视收入出现下滑。在8个国家——美国、巴西、墨西哥、瑞典、日本、新西兰、挪威和委内瑞拉——运营商能够通过增加其剩余订阅所产生的收入来弥补客户流失的损失。即使2017年美国有330万付费电视用户流失,运营商仍能够通过增加销售和提价来集体提高付费电视收入。

自2002年以来,拉丁美洲的付费电视订阅量出现了首次净下降,而有线电视的减少在一定程度上导致了两个主要市场的下滑。巴西付费电视订阅量减少61.7万,墨西哥则减少了19.2万,经济困难也让他们损失惨重。同时,由于该国的金融危机恶化,委内瑞拉的付费电视市场减少了1.6万个订阅。

由于350万订阅的净亏损,北美去年遭受了有史以来最大的年度付费电视降幅。在2012年至2017年间,该地区的付费电视订阅量下降710万。同时,Netflix和其他超顶级(OTT)订阅视频服务同期的净增额为1.013亿,而2017年新增的订阅量超过2,600万。

有线电视的削减趋势愈演愈烈,卫星电视在若干地区也陷入困境。在2017年,它比北美和拉丁美洲的任何其他平台都下降得更多,分别遭受180万和88.2万的净亏损。

“作为他们对有线电视的回应的一部分,越来越多的付费电视运营商推出了自己的独立流媒体服务,直接与Netflix、亚马逊Prime Video和其他OTT视频公司的产品进行竞争,”Hall说。这些虚拟付费电视替代传统付费电视的方式更加灵活,价格通常低于运营商的核心产品。但是,将付费电视订阅替换为OTT只是一个部分解决方案,因为这些服务的用户人均收入较低,因此对运营商来说价值更低。

展望未来

IHS Markit数据预测,未来5年付费电视市场的表现将进一步削弱北美市场,预计2017年底至2022年底,将有850万付费电视订户减少。拉丁美洲随着巴西的经济复苏,将恢复增长。

在世界其他地方,除了大多数地区付费电视订阅量的增长外,在线视频的激增还将继续。预计到2022年底的5年时间里,除了中东和非洲,在付费电视增长更快的地区之外,OTT网络的新增用户预计将超过付费电视。预计全球将会有4.09亿的OTT视频订阅,其中近三分之二来自亚太地区。

附英文版内容

Pay TV Subscriptions Declined in 14 Markets in 2017 asCord Cutting Takes Toll.

LONDON (May 3, 2018) – The cord-cutting trend thatthreatens the future of the global pay TV industry was not confined solely tothe United States in 2017; total pay TV subscriptions also declined in 13 othermarkets. Customers cancelling their TV services in favor of online alternativeshas been a key factor in declining subscriptions for cable, satellite, IPTV andpay digital-terrestrial TV around the world, according to business informationprovider IHS Markit(Nasdaq: INFO).

The 13 markets in which total pay TV subscriptionsdeclined last year, in addition to the US, were Brazil, Mexico, Hong Kong,Canada, Sweden, Denmark, Japan, New Zealand, Norway, Singapore, Israel,Venezuela and Ireland, IHS Markit said.

“The cord-cutting woes of pay TV companies in the US have been wellpublicized,” said Ted Hall, director of research and analysis for TV and videoat IHS Markit. “Although the rest of the world has been broadly resisting thetrend, other markets have also experienced pay TV subscription losses.”

Significantly, only 6 of the 14 markets affected in2017 also experienced declines in pay TV revenue. In eight countries — the US,Brazil, Mexico, Sweden, Japan, New Zealand, Norway and Venezuela — operatorswere able to compensate for customer loses by increasing the amount of revenuegenerated by their remaining subscriptions. Even in the US, where 3.3 millionpay TV subscriptions were lost in 2017, operators were able to collectivelyincrease pay TV revenue by relying on upselling and price increases.

Latin America experienced its first net decline in payTV subscriptions since 2002 last year, with cord cutting contributing in partto decreases in two major markets. Brazil lost 617,000 pay TV subscriptions,while Mexico declined by 192,000, as economic difficulties also took theirtoll. Meanwhile, Venezuela’s pay TV market lost 16,000 subscriptions, as thecountry’s financial crisis worsened.

With a net loss of 3.5 million subscriptions, NorthAmerica suffered its biggest-ever annual pay TV decline last year. Between 2012and 2017, pay TV subscriptions fell by 7.1 million in the region. Meanwhile,net additions for Netflix and other over-the-top (OTT) subscription videoservices totaled 101.3 million over the same period, with more than 26 millionOTT subscriptions added in 2017.

The cord-cutting trend has been most stronglyassociated with cable TV, but satellite TV is also struggling in severalregions. It declined more than any other platform in both North America andLatin America in 2017, suffering net losses of 1.8 million and 882,000,respectively.

“As part of their response to cord cutting, a growingnumber of pay TV operators are launching their own standalone streamingservices to compete directly with offerings from Netflix, Amazon Prime Videoand other OTT video companies,” Hall said. “These virtual pay TV alternativesto traditional pay TV are more flexible and typically priced lower thanoperators’ core offerings. However, substituting pay TV subscriptions for OTTis only a partial solution, as these services have lower average revenue peruser and are therefore worth less to operators.”

Looking to the future

Forecasting the performance of the pay TV market overthe next five years, IHS Markit anticipates further cord cutting in NorthAmerica, with a net decline of 8.5 million pay TV subscriptions anticipatedbetween the end of 2017 and the end 2022. Latin America is expected to returnto growth, as Brazil continues on the path of economic recovery.

Elsewhere in the world, alongside the growth of pay TVsubscriptions in most regions, the surge in online video will continueunabated. Over the five years to the end of 2022, OTT net additions areexpected to outstrip those of pay TV everywhere except the Middle East andAfrica, where pay TV will grow faster. In total, 409 million OTT videosubscriptions will be added globally over the forecast period, with almosttwo-thirds to come from Asia Pacific.

2015年12月25日全面上线。目标:打造全球数字营销技术领域首席媒体平台,成为中国乃至全球数字营销内容聚合门户。目前团队积极依托专业素养,全力为数字营销领域从业者搭建有质感的交流空间。感谢相伴!

文章:3154

0条评论